As healthcare providers, we pour so much effort into delivering quality care that the administrative side—particularly denials—often ends up as a silent drain on our revenue. What we don’t see can hurt us. Denials not only delay payment but can lead to lost revenue from denials that we may never recover if left unaddressed. At Gables Medical Billing, we’ve learned that by proactively tracking, analyzing, and correcting these issues, we can recover more than we thought possible.

Understanding the Impact of Denied Claims

Denied claims may seem like a standard part of doing business, but if we dig deeper, we’ll find many of these denials stem from preventable issues—incorrect codes, missing prior authorizations, or late submissions. Over time, they accumulate, creating a backlog of aged claims that represent missed reimbursement opportunities. Tackling this problem means more than just working denials—it means reshaping our revenue cycle strategy to reduce them in the first place.

Reporting and Filtering Unpaid Claims

Reporting and Filtering Unpaid Claims

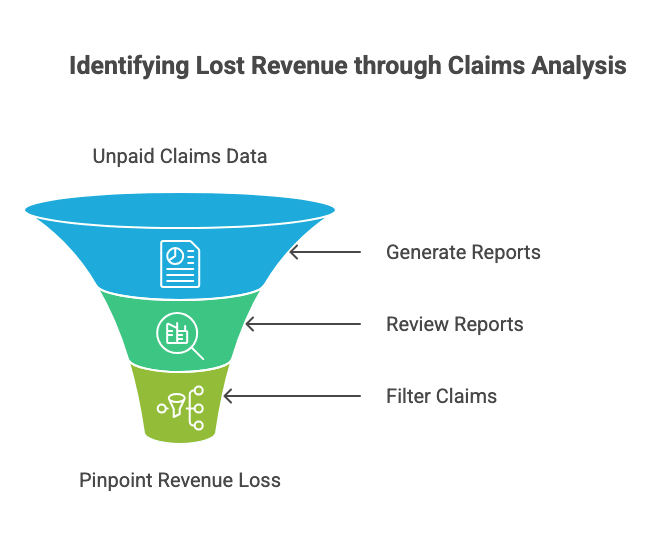

The first step in identifying hidden lost revenue is to implement a robust reporting system for unpaid claims. By leveraging technology and financial analytics, practices can generate detailed reports that filter unpaid claims according to various parameters such as dates, amounts, and denial reasons. This approach helps in pinpointing specific areas where revenue is being lost.

- Utilize practice management software to generate real-time reports.

- Regularly review and update these reports to catch new denials promptly.

- Filter claims by age to focus on aged claims follow-up

Identifying Patterns in Denied Claims

Once you have a report of unpaid claims, the next step is to identify patterns that may indicate systemic issues. By analyzing these patterns, practices can address the root causes of denials, whether they stem from specific insurance companies, common coding errors, or procedural oversights.

- Review claim denial reasons and categorize them.

- Identify the most common denial codes and investigate their causes.

- Implement corrective measures to prevent future denials.

Focusing on High-Yield CPT Codes

Not all claims carry the same financial weight. Focusing on high-yield CPT codes—those that represent high-value services—can help prioritize efforts in recovering lost revenue. By ensuring these claims are accurately coded and submitted, practices can significantly improve their financial outcomes.

Implement regular audits to ensure high-yield CPT codes are correctly applied and documented. Training staff on the importance of these codes and how to handle them can also reduce the likelihood of errors that lead to denials.

The Importance of Prior Authorization

Prior authorization is a critical step in the billing process that, if overlooked, can lead to denials and missed reimbursement opportunities. Ensuring that all necessary authorizations are obtained before services are rendered can prevent many denials from occurring in the first place.

Addressing Prior Auth Denials

Prior authorization denials are common and can be challenging to manage. These denials occur when a service is provided without the necessary pre-approval from the insurer. To mitigate this, practices should implement a stringent pre-authorization process:

- Verify insurance requirements for authorization before scheduling services.

- Maintain a list of procedures that require prior authorization.

- Use technology to automate authorization requests and track approvals.

Staying Within Filing Limits

Another sneaky source of lost revenue from denials? Missed deadlines. Every payer has different filing limits, and once a window closes, that claim is gone for good. We avoid that entirely by standardizing timely submissions.

Ensuring Timely Submission

To avoid denials due to missed filing limits, practices should establish a streamlined workflow that prioritizes timely claim submissions. Implementing electronic claims submission can expedite this process and reduce the likelihood of missing deadlines.

- Set reminders for approaching filing deadlines.

- Regularly audit claim submission timelines to ensure compliance.

- Train staff on the importance of adhering to filing limits.

Conducting an Unpaid Claim Audit

An unpaid claim audit can uncover hidden revenue from aged claims that might otherwise be written off. This audit involves a detailed review of all outstanding claims, identifying those that are still recoverable and taking the necessary steps to resubmit or appeal these claims.

Steps to Conduct an Effective Audit

Conducting an audit requires a systematic approach:

- Gather Data: Compile a comprehensive list of all unpaid claims, including details such as dates, amounts, and denial reasons.

- Analyze Trends: Look for patterns in the data that may indicate systemic issues or opportunities for improvement.

- Develop Action Plans: Create targeted strategies to address the underlying causes of denials and recover unpaid claims.

By conducting regular audits, practices can ensure they are not leaving money on the table and can take proactive steps to improve their revenue cycle management.

Partnering with Experts

Tackling all this on our own can be overwhelming. That’s why we trust Gables Medical Billing to support our end-to-end revenue cycle. Their expert team helps us manage denials, maintain compliance, and recover payments we’d otherwise lose. With their help, we spend less time chasing claims and more time serving patients.

Recovering lost revenue from denials isn’t about fixing one or two claims—it’s about building a smarter system. With strong reporting, sharp audits, and a laser focus on prior authorizations and high-yield codes, we’ve dramatically improved collections and tightened our financial operations. Most importantly, we’ve built a proactive, responsive billing process that helps us stay ahead of denials before they ever happen.

If you’re tired of writing off revenue or feel buried under aged A/R, it’s time to take action. Let Gables Medical Billing help you audit, analyze, and recover what’s rightfully yours. Get in touch with us to learn how we can support your financial health—one claim at a time.